Insurance Claims – Two Lies and One Truth

These are some of the lies and truths we hear while dealing with clients and their insurance carriers.

Insurance Claims – Two Lies and One Truth

I hear lies all of the time. Sometimes I know it immediately and other times the truth doesn’t come out until later. Many times I hear lies that were told to customers by their insurance company.

LIE 1 – MY INSURANCE COMPANY SAYS I HAVE TO USE THEIR CONTRACTOR

Some insurance companies create relationships with some of the larger restoration companies. These restoration companies agree to discount their rates in order to become a “preferred vendor” for that insurance company (as much as 10% to 15% or even more). On the surface, this sounds like a good thing. Your home or business is repaired and the claim will cost less. The less the insurance company pays the less your rates will go up, right?

The Problem: Many of these big name restoration companies are dependent on this work as a “preferred vendor” and when choices have to be made about repairing your home or business, will the restoration contractor “bite the hand that feeds it”? When they derive a high percentage of business from this insurance company (sometimes 40%-60% and as high 80% of their business come from these “preferred” relationships), who will they defer to and who will they consider to be their customer – you or the insurance carrier?

To make matters worse, we have seen insurance companies bully and lie to customers. They insist that you use their vendor not because they are “better” or “more qualified” but because the insurance company is trying to save money. They might even accuse the company you hired of over-charging you (because their vendor is offering the service at a discounted rate).

This is an extremely stressful time for you. Your home or business is flooded, or a tree has fallen on your roof, maybe you’ve found mold in your attic.

Your insurance company knows that you are stressed and vulnerable and many will abuse that fact to their own ends.

The Solution: As a property owner, it is your responsibility to mitigate further damage. If you’ve experienced a disaster – whether it’s a sink over-flowing and flooding your bathroom or the hot water heater in your finished basement ruptured and there’s 6-inches of water flooding your beautiful rec room – you need a professional on site as quickly as possible. A professional can help you extract the water, move contents, and start the drying process. Any delay could cause further damage due to the water/moisture spreading and mold can grow within 24 to 48 hours. You don’t have time to wait for the insurance company’s adjuster to show up 3 days from now (or even a week or two later)!

You have the right to hire any qualified contractor. You have the right to hire a contractor that you trust. You have a right to hire a contractor that can walk you through the process and help you defend your rights. We help our customers file their claim and we work with our customers to communicate with the insurance company and the company’s adjuster assigned to the case. You – our customer – are our one and only priority. You have the right to have your property returned to “pre-loss condition” and that might mean the insurance company is going to have to spend more than they want to. Know your policy, know your coverage, know your rights, and hire a contractor that will serve your best interest and not their own interests or those of your insurance carrier.

LIE 2 – THE INSURANCE COMPANY TOLD ME THEY COULDN’T PAY MORE THAN $XX,000

I experienced this situation recently: My customer is serving in the armed forces and has been out of country for an extended period of time. Their home is occupied by a tenant that allowed significant damage to go unchecked and uncorrected (see photos). The entire home, two-stories and a finished basement (approximately 1,500 square feet) needs to be remediated for mold, water damage, and moisture. Due to the contamination, all three floors need to be gutted down to the studs (walls, ceilings, and floor coverings) and then sanitized.

For a novice this is an insurmountable task. For a professional mold remediator, this is just another day at the office. A proposal was drawn up and submitted to the customer, approximately $25,000 to remove building materials, dispose of all contaminated materials and contents, and sanitize the home for re-construction.

The customer told me that his insurance company had already given him a number they would pay and if he paid me my price, he would have no money left to rebuild. My heart sank. Not because I was losing this job and potential revenue, but because this man’s insurance company was turning him into a victim all over again. That’s not right!!!

Mold is not covered under all policies – often it is added to policies as a rider for $5,000 or $10,000 of coverage. However, this home was completely covered because it was from an unforeseen water loss and the homeowner is not at fault in any way. The insurance company even told our customer that this loss will be completely covered…but suddenly they can only pay $xx,000.

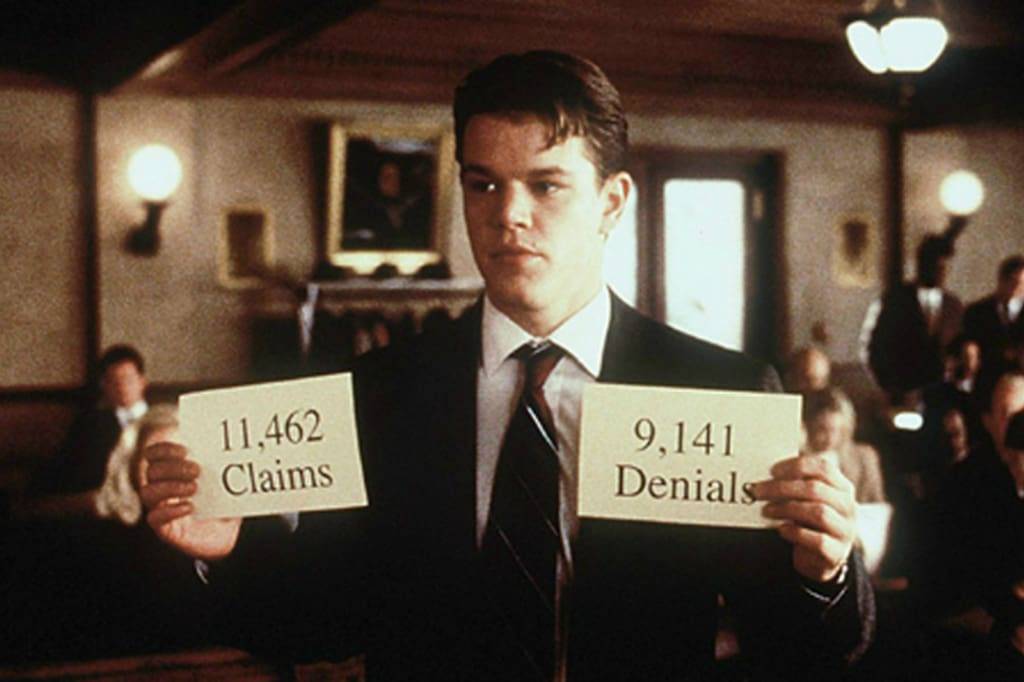

The Problem: Understanding how adjusters and insurance companies work. The first thing an adjuster will do on your loss is develop a loss value (LV) and assign it a dollar amount. They will report this amount to your insurance carrier and advise them to set aside $XX,000 for your loss.

The insurance carrier and the adjuster know the LV and you don’t. The adjuster will now make offers to you as low as they think they can get away with. These offers often start at 40% of the LV. If an adjuster is willing to write a check on the spot, you can be fairly certain it’s for less than half the LV. In many states, they can even be deceptive and tell clients they can’t go higher. They manipulate pricing and will haggle until they’re blue in the face – making you a victim all over again.

WHY?? Why would they do this? Many adjusters are evaluated based on their Payouts vs. Loss Values. Some even have their compensation determined based on that number. Many insurance companies offer bonuses, or commissions, on the differences between LV and payout. The commission percentages for these adjusters go down as time passes, so they have multiple incentives to close your claim quickly and for the lowest amount possible.

The Solution:

Work with your contractor to get a a rough idea of what it will cost to clean up and rebuild after a disaster.

Never accept the first offer from you insurance company or adjuster without knowing how much it will take to cover your loss.

If you do accept an offer from your insurance carrier and realize it was a mistake, you still have options (no matter what they tell you). You can hire a Public Adjuster to represent you, they may be able to help you get supplemental coverage. Your adjuster and/or your insurance carrier may have negotiated with you in bad faith, if they have you can report them to your state’s insurance commissioner.

Hire a contractor you can trust, one that will help you through this process from your very first phone call.

TRUTH – I DON’T LIKE FIGHTING WITH INSURANCE COMPANIES, BUT I WILL

Many of them don’t fight fair. Some mislead their customers, give them bad information, and outright lie in order to save money. I have always represented my customers and their best interests, but even the best and most educated customer can start to have doubts when their insurance carrier starts threatening them with financial loss.

Hypothetical Example: We perform emergency water extraction and drying for a customer and provide them with an itemized and detailed bill, photo documentation, drying logs, and site sketches which they submit to their insurance carrier – $7,500. Our customer is thrilled with our work because their business had minimal impact due to how quickly and efficiently we cleaned up the loss – working nights and weekends to get it done. The insurance carrier now wants to “negotiate” the price of services already rendered. They tell our mutual customer that they will only cover $4,500 because the property should have been dried in two days instead of four (regardless of our documentation with moisture readings etc.) and that any difference will have to be covered by the insured. This is where doubt sets in. Our customer was thrilled, but now they might be on the hook for $3,000 and now the insurance company has suggested that I may have even “padded the bill.”

This is a lie of course, but that little bit of doubt is all the insurance company needs. Once my customer has been given a little doubt, backed up with the threat of financial loss, they no longer know who to believe. The insurance company has now effectively made me out to be the bad guy in an attempt to save money. Make no mistake, this is a deliberate and intentional tactic used by adjusters and insurance companies, because it is in the interest of the insurance carrier to pay out the least amount of money as possible.

Reliable prioritizes building relationships over making a quick profit.

We believe no one deserves to live in fear of their home making them sick – at Reliable Remediation we help people find peace of mind by restoring the health and safety of their home after water, fire, and mold damage.